Exposed to the forces of trade liberalization and globalization, smallholder farmers face an uncertain future. The enormous returns to scale present in highvalue chains, the subsidies received by farmers in countries that are members of the Organisation for Economic Cooperation and Development (OECD), and a generally weak infrastructural and institutional environment in many developing countries all threaten the competitiveness of smallholder agriculture. It often appears that smallholders’ only alternatives are to rent out to agribusiness concerns and become laborers on their own land, or exit the industry and migrate out of rural areas altogether.

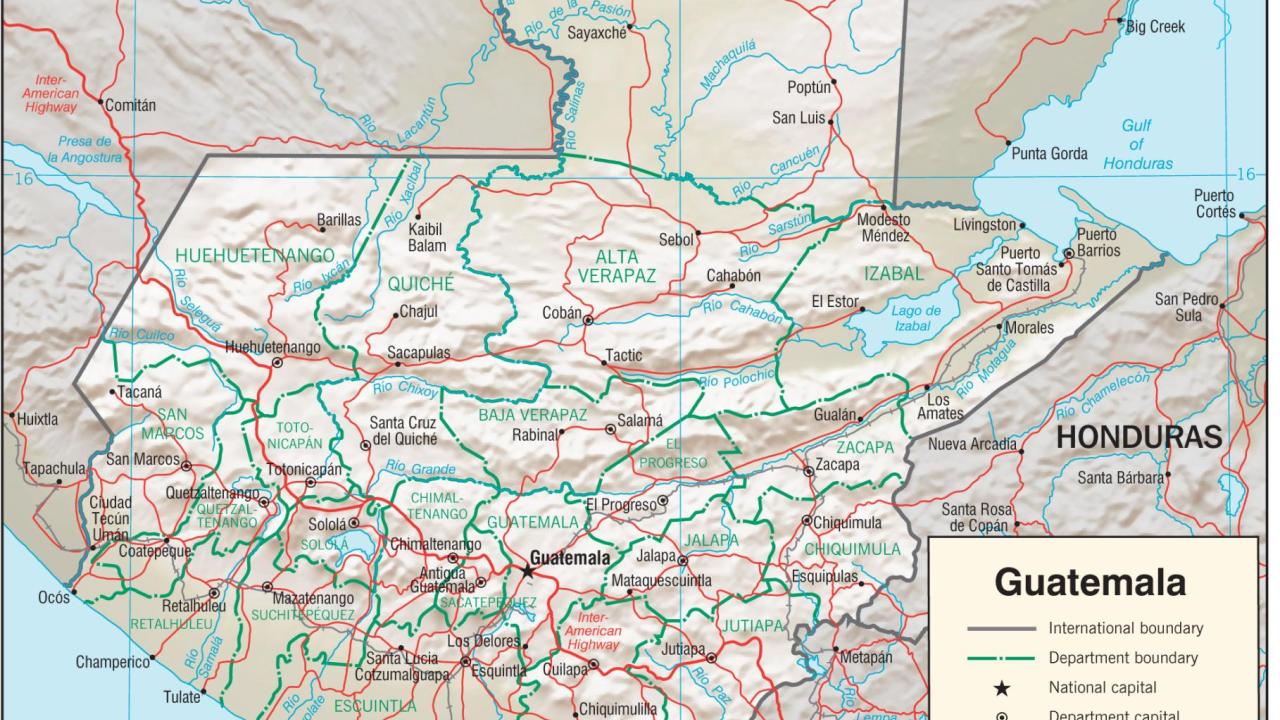

Our project will carry out research in Guatemala to explore three innovations that offer the potential to enhance the competitiveness of smallholder agriculture. We will give significant attention to the emergence of niche markets for high-value products, in particular coffee through the Fair Trade (FT) movement, which will be analyzed in terms of consumer demand in the United States, supply response in participating cooperatives, and incidence of benefits among participating and nonparticipating cooperatives. We also will look at efforts to link credit to insurance in order to make it safer and easier for smallholders to access credit. This will be analyzed through testing during a phased rollout of a national agricultural insurance program and a major microlender’s deployment of a new insurance scheme.

Our project will carry out research in Guatemala to explore three innovations that offer the potential to enhance the competitiveness of smallholder agriculture. We will give significant attention to the emergence of niche markets for high-value products, in particular coffee through the Fair Trade (FT) movement, which will be analyzed in terms of consumer demand in the United States, supply response in participating cooperatives, and incidence of benefits among participating and nonparticipating cooperatives. We also will look at efforts to link credit to insurance in order to make it safer and easier for smallholders to access credit. This will be analyzed through testing during a phased rollout of a national agricultural insurance program and a major microlender’s deployment of a new insurance scheme.

Finally, we will continue our examination from a previous BASIS project on the use of credit reporting bureaus by microfinance lenders. The credit bureau research, done in cooperation with several major lenders in Guatemala, will extend the long-run panel data gathered on how well smallholder clients are able to signal their creditworthiness to lenders through the bureaus, which allows for more lending to better clients and even the possibility that many of these smallholders can graduate to becoming borrowers in the commercial banking sector.

There is much enthusiasm and a great deal of narrative evidence about the promise of these innovations, but to date there is little statistical evidence regarding their impact. Guatemala is an excellent natural laboratory because it combines an unusually large smallholder sector with a rapidly growing highvalue agricultural export sector. We have built a substantial research infrastructure with collaborators in the country, including universities, the Ministry of Agriculture, the Ministry of Finance, the National Association of Cooperatives, and all three lenders currently extending innovative financial products to smallholders. During our project, the Central American Free Trade Agreement will go into effect, which will present a substantial shock to import and export prices. This will allow us to study the ability of the three innovations to shield smallholders from the potentially adverse consequences of globalization.

Fair Trade

FT coffee, which has seen explosive recent growth, provides an opportunity for smallholders to be competitive in reaching global markets. A market that did not exist in 1998 saw 30 million pounds of coffee traded in 2004 and 65 million in 2006. A single certification allows producers to receive a higher, guaranteed price for every unit produced, leading many smallholders to now grow coffee for FT. This has created a large supply of FT coffee for market, yet if the markets are not sufficiently structured, they will fail to deliver any benefit to the producers. Our project will compare the targeting, impact, and risk effects of FT against other transfer mechanisms.

The minimum prices of $1.26/lb and $1.41/lb that licensed FT importers have to pay to farmers for conventional and organic coffees, respectively, have been substantially above the international market price over the past few years, yet the prices represent a small share of the retail prices, which range from approximately US$5 to US$12 per pound. The FT movement often claims that with fewer intermediary costs than in the standard value chain, FT coffees are not necessarily more expensive than non-FT coffee. In the first phase of our project, we will conduct an analysis of price along the FT and non-FT value chains that connect Guatemala and the rest of the world. This will allow us to compare FT with other aid delivery mechanisms whose effects are often eroded by excessive administrative costs. An advantage of FT may be precisely the fact that it piggybacks on existing supply chains and so presents an efficient means to transfer income from the rich to the poor.

Essentially, the only difference between FT and non-FT products is the price received by the producer. As coffee is a highly differentiated product, there is no clear indication that the premium that consumers pay for FT coffee is either lower or higher than the markup received by the producer. The premium reflects consumer willingness to pay more for FT coffee in order to support farmers, and we can compare this form of charity to other forms, such as national aid organizations and private charities.

Thus we will be able to examine the factors that cause consumers to choose FT as a way of promoting equity. Through supermarket studies we expect to conduct experiments in which we alter the perceived characteristics of FT products and observe the consumer response in the United States through an analysis of product purchase data. Exit surveys will help reveal characteristics of the consumers that purchase FT and non-FT coffee. By adjusting information on the consumer price markup and the nature of the FT product, we can alter the messages sent with FT marketing, including the share of the transfer that makes it directly to producers, the size of the premium, and the degree to which “organic” and other process attributes are associated with the product. This not only provides FT producers valuable information in marketing but also allows us to find out what fraction of people are willing to make a direct transfer of their own income to others, and what are the characteristics associated with this type of “aid.”

Our project team also intends to carry out surveys in Guatemala of cooperatives and households that are members of cooperatives in order to gather data on who participates in FT production, including whether they take credit or insurance. An important aspect of the household survey is to identify the characteristics of the households that do not yet have access to FT certification. We will track these households to see which achieve certification in the future. In this way, we can compare these households with households who receive conditional cash transfers in other central American countries to better understand the targeting process and how it might differ across innovations.

By carrying out the surveys of cooperatives and households in two waves, we can measure changes introduced by the experiments we conduct. Within the pool of producers who want to become certified, we can work with the certification agency to create experimental variation in the sequence in which they are certified. By performing the follow-up survey partway through this rollout process, we will have a randomized trial that allows us to assess the impact of the FT on household outcomes. We will be able to compare the impact on a household engaged in FT production to households benefiting from other programs aimed at developing the economic growth of poor households. We also will see if non-FT farmers are expanding output at the same rate as FT farmers. Environmental effects also can be studied, showing the differences in ways farmers produce the different kinds of coffee, and if, when prices for coffee rise, they clear new land or use more mechanized methods of production.

A crucial component of the FT coffee market is that the FT price is fixed while the market price fluctuatesunderneath it. Risk-averse producers will have an additional incentive to get certified and produce FT coffee. Ironically, in this case FT would replace the “low risk, low yield” crops that trap many people in poverty. Cooperatives might even be willing to become certified when profits from doing so were negative, with that loss seen as a premium paid on the insurance provided by the fixed FT price. The household surveys will thus focus on risk-sensitive behavior.

We also can study how FT and quality certifications interact. Since each producer receives a single price per pound for organic FT coffee and a single price for non-organic FT, this creates an incentive for farmers to sell their lowest-quality product as FT, reserving the high-quality output for the non-FT market where quality can raise the price received. Thus FT consumers may, in effect, be willing to buy poorer quality coffee because they know it does something good. Because the cooperatives keep detailed information on the quality grades and prices at which they have sold, we will be able to examine this phenomenon empirically, comparing the trajectory of what is sold at FT and non-FT prices.

Insurance and the Demand for Credit

Financial constraints can impede the competitiveness of smallholder farming. Often this is due to the fact that many smallholders lack the type of collateral that would allow them to borrow from a lender. Yet, also, there is increasing evidence that smallholders do not seek to borrow precisely because they choose not to place the collateral they do have, often their land, at risk. This aspect of our work is designed to add to the understanding of how credit and insurance products can be structured to reach small farmers in Guatemala, and, most importantly, whether this helps them improve the profitability of the crops they produce.

In 2004 the Guatemalan government introduced an agricultural insurance program known as Dacredito, which provides subsidized reinsurance to commercial banks. The insurance payouts are based on the regional output of the crops covered, and the primary intent of the program is to protect small farmers from the risk imposed by major natural disasters such as hurricanes.

At present, several large banks offer insurance products backed by the Dacredito guarantee, yet these insurance policies have been directed primarily to the supply-chain intermediaries—those who provide seeds, fertilizer, and transport services to cooperative farmers. There is a push to extend these insurance products further down the supply chain, so that they are offered directly to smallfarmers. We intend to work with the financial institutions providing this insurance to create variation experiments that can be used to identify impacts. Several current studies of insurance measure the impact on mean household income, yet this is not the most relevant outcome since the mean impact of having insurance depends almost entirely on the state of nature during the period of study. A better aspect to explore is the extent to which the presence of insurance makes producers more willing to use complementary output tools such as credit, high-value crops, and so on.

In order to understand the longer-term impacts of the insurance, we hope to work with financial institutions that provide loans and crop insurance to financial cooperatives. This would allow us to create a randomized rollout of the ordering in which the institutions offer the insurance product directly to cooperative farmers, and measure the intention-to treat effects of this process. Our survey of cooperatives, along with institutional data, will allow us to test whether insurance is enabling smallholders to transition to more high-value cash crops over time. In a coffee cooperative, for example, we can analyze the impact insurance has on the quantities of different grades produced and prices received, and therefore we can further observe improvements in profits caused by the insurance.

Meanwhile, data from the lending institutions would let us study the ways in which the deepening of insurance markets may lead to a corresponding expansion of credit markets. The risk rationing hypothesis suggests that the absence of insurance impedes smallfarmers from seeking credit. We could test to see if removing this constraint increases lending. We also could use lender data, along with information about the households and regions, to find out if the impact of insurance is greatest in regions that have the largest rainfall variation, and/or if it is larger in regions that have economies that are less diversified away from agriculture.

Risk reduction via insurance can change the contractual arrangements through which unsecured loans are obtained from microfinance lenders. For example, if the degree of insurance induced by joint liability made group loans prominent in a region, then we should see individual lending in the MFI portfolio increase as insurance coverage improves. We also can examine the role that offering insurance plays in boosting the performance of the lending institutions by looking at the change in overall default rates, employee efficiency, and retention rates. If the cooperatives in our study have kept high-quality panels that go back before they received loans, then there may also be an opportunity to identify the impact of credit on the supply chain and cropping patterns of the cooperatives.

Credit Bureaus

We have developed a sustained collaborative relation with Genesis, the largest microfinance lender in Guatemala. This association has been mutually beneficial, helping the lender understand how credit bureau information is used by credit agents and how it affects client behavior, and helping us understand the efficiency and welfare gains (and losses) from introducing a credit bureau into microfinance lending. A main goal is to determine if credit bureaus help clients use their accumulated reputation with a microfinance lender to gain access to more loans and to loans from the commercial banking sector. This is a long-term process that we have partially traced by looking at the Genesis clientele. The data will be extended to include more smallholders, which will allow us to see if a credit bureau contributes to smallholder competitiveness in the context of the ongoing globalization and trade shocks. The long-term panel data on microfinance clients, complemented by detailed case studies, will allow us to trace the impact credit bureaus have on helping clients move up the lending ladder.

Improving the Innovations

Overall, the components of the project will result in a better understanding of the opportunities offered by institutional innovations for the competitiveness of smallholders in the context of globalization. Our results on access to niche markets such as FT coffee, linking credit to insurance, and using credit bureaus to provide public signals about good borrower behavior will help the private sector improve the products they deliver. Further, the results will provide the foundation for recommendations to regulators and policymakers on designing policy reforms and public investment programs so that these innovations can be more effective in enhancing smallholder competitiveness.

Further Reading

Arnot, C., P. Boxall, and S. Cash. 2006. “Do Ethical Consumers Care about Price? A Revealed Preference Analysis of Fair Trade Coffee Purchases.” Canadian Journal of Agricultural Economics 54: 555-65.

Bacon, C. 2005. “Confronting the Coffee Crisis: Can Fair Trade, Organic, and Specialty Coffees Reduce Small-Scale Farmer Vulnerability in Northern Nicaragua?” World Development 33(3): 497-511.

Becchetti, L., and F. Rosati. 2006. “Globalization and the Death of Distance in Social Preferences and Inequity Aversion: Empirical Evidence from a Pilot Study on Fair Trade Consumers.” CEIS Working Paper 216.

Farnworth, C, and M. Goodman. 2006. “Growing Ethical Networks: the Fair Trade Market for Raw and Processed Agricultural Products (in Five Parts) With Associated Case Studies on Africa and Latin America.” RIMISP working paper.

Leclair, M. 2002. “Fighting the Tide: Alternative Trade Organizations in the Era of Global Free Trade.” World Development 30(7): 949-58.

Pelsmacker, P., L. Driesen, and G. Rayp. 2005. “Do Consumers Care about Ethics? Willingness to Pay for Fair-Trade Coffee.” The Journal of Consumer Affairs 39(2): 363-85.

Publication made possible by support in part from the US Agency for International Development Cooperative Agreement No. EDH-A-00-06-0003-00 through the Assets and Market Access CRSP. All views, interpretations, recommendations, and conclusions expressed in this paper are those of the authors and not necessarily those of the supporting or cooperating organizations.