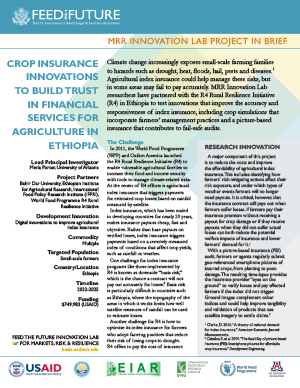

Climate change increasingly exposes small-scale farming families to hazards such as drought, heat, floods, hail, pests and diseases.[1] Agricultural index insurance could help manage these risks, but in some areas may fail to pay accurately. MRR Innovation Lab researchers are testing innovations that improve the accuracy and responsiveness of index insurance, including crop simulations that incorporate farmers’ management practices and a picture-based insurance that contributes to fail-safe audits.

The Challenge

Project Overview

Lead Principal Investigator: Maria Porter, University of Arizona

Project Partners: Bahir Dar University, Ethiopian Institute for Agricultural Research, International Food Policy Research Institute (IFPRI)

Development Innovation: Digital innovations to improve agricultural index insurance

Commodity: Multiple

Targeted Population: Small-scale farmers

Country/Location: Ethiopia

Timeline: 2020-2025

Funding: $833,084 (USAID)

One tool for vulnerable agricultural families to increase their food and income security with tools to manage climate-related risks is agricultural index insurance that triggers payments for estimated crop losses based on rainfall measured by satellite.

Index insurance, which has been scaled in developing countries for nearly 20 years, makes insurance payouts cheap, fast and objective. Rather than base payouts on verified losses, index insurance triggers payments based on a remotely measured index of conditions that affect crop yields, such as rainfall or weather.

A challenge for index insurance programs is known as downside “basis risk,” which is the chance a contract will not pay out accurately for losses.[2] Basis risk is particularly difficult in countries such as Ethiopia, where the topography of the areas in which it works limits how well satellite measures of rainfall can be used to estimate losses.

Research Design

MRR Innovation Lab researchers are testing multiple approaches to improving the accuracy and responsiveness of index insurance for small-scale farmers in Ethiopia. Biophysical crop simulations will make it possible to quantify the effects of farmers adopting risk-reducing practices. A picture-based insurance (PBI) approach that uses smartphone images of insured crops will contribute to seasonal crop monitoring and can be used to settle claims if the index does not trigger a payout.

The project will use a randomized controlled trial (RCT) to evaluate the impacts of these innovations. The RCT includes 1,280 households in 80 villages in the Amhara region of Ethiopia. Forty villages each are randomly assigned to one of two groups.

The first group will be exposed to a regular index insurance program. The second group receives the same program, but now the index insurance design will incorporate farmers’ adoption of risk-reducing practices and picture-based insurance to support a fail-safe contract.

The team is studying farmers’ take-up of the newly designed index insurance, both in terms of willingness to participate in the standard index insurance program, and to pay the cost of insurance premiums. The project is also generating insights on how to design gender-responsive insurance. Insurance coverage is often found to be lower among women, who face additional risks outside of agriculture, such as health risks in fertility and childcare.

Development Impact

This project seeks to address a number of objectives in the USAID Country Development Cooperation Strategy for Ethiopia. These include objectives related to disaster risk management (DO1), resilience among vulnerable populations (DO2), private-sector-led economic growth (DO3) and essential service delivery to women and girls (DO4).

Agricultural productivity improvements, which can be made possible by implementing high-quality agricultural index insurance, are key to achieving Feed the Future goals of eliminating hunger and extreme poverty. With lower basis risk and more timely payouts, index insurance can enable farmers to increase their use of fertilizer, plant new seed varieties and adopt complementary farm management practices. Such changes in practices can perhaps make smallholder farming profitable, which can then ensure long-term food security.

[1] Porter, J.R., et al. 2014. “Food security and food production systems.” Climate Change 2014: Impacts, Adaptation, and Vulnerability. Fifth Assessment Report of the Intergovernmental Panel on Climate Change.

[2] Hill, R.V., et al. 2016. “Demand for a simple weather insurance product in India: theory and evidence. American Journal of Agricultural Economics.

This report is made possible by the generous support of the American people through the United States Agency for International Development (USAID) cooperative agreement 7200AA19LE00004. The contents are the responsibility of the Feed the Future Innovation Lab for Markets, Risk and Resilience and do not necessarily reflect the views of USAID or the United States Government.